The past decade has shown that if banks fail to innovate and invest, fast-growing payment companies like Stripe and Adyen will challenge their position. With simple, easy-to-use merchant solutions they grew swiftly alongside the spectacular growth of eCommerce. 2020 illustrated that eCommerce is going nowhere but up. Building on their online success, players like Stripe and Adyen now seek to expand beyond eCommerce into other banking services.

Nonetheless, just because banks are late to the eCommerce party does not mean they shouldn’t attend. Banks have substantial advantages that other, newer players do not. They have built up long-standing trust and brand loyalty. And they are poised to couple merchant solutions with their existing banking and treasury services. If banks act now to improve merchant services, they will prosper.

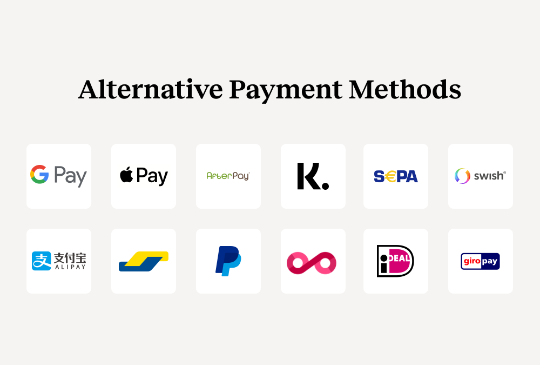

1. Offer the right Alternative Payment Methods (APMs)

Having a few APMs (non-cash or non-credit-card payment options) is a fundamental starting point. Think about adding a few big players: Apple Pay, Google Pay, Klarna, and PayPal. However, this alone will not be enough. Why? Each market and country has its payment preferences and localized options.

One glance across the European ecosystem makes this apparent. In the Netherlands, consumers often opt for iDeal, in Sweden there’s Swish, in Germany Giropay and in Belgium, Bancontact. Your merchants want to offer their customers choice and convenience during checkout with a wide array of these localized payment options.

The data shows two things: First, APM transactions are on an upward trend, encompassing 55% of eCommerce transactions. Second, when merchants do not offer localized APMs, the checkout abandon rate is high and dramatically lowers overall conversions. To help merchants improve their checkout conversion rates, banks need to ensure seamless transactions by offering localized payment options.

However, it’s not just about the APMs; it’s about having the right APMs. This is where Ginger steps in to help banks improve their merchant services. At Ginger, we’re ready to add APMs to your existing solutions, and we can do it in less than three weeks. Read more about Ginger’s speed and agility in implementing APMs.

Alternative Payment Methods

2. Provide the right eCommerce Shopping Cart Plugins

Now more than ever, SMEs are selling their products and services online. As part of this process, merchants must choose one of the many available eCommerce software options (Shopify, Magento, WooCommerce, Prestashop, Shopware, OpenCart, Zencart, Ecwid, etc.) when building their website.

Once the website goes online, they need a simple, integrated tool to accept online payments. The merchant will look for a bank or payment provider that offers pre-built integrations and plugins for their specific eCommerce software. In short, there needs to be an agreement between the site’s eCommerce software and the bank’s plugins to get up and running.

As such, banks need to have shopping cart plugins ready and installed so merchants can easily integrate them into their sites. Every client of Ginger can offer our 18+ shopping cart plugins to all their merchants, meaning they can service almost anyone instantaneously.

Why only offer one or two plug-ins when you could have more than 18 with Ginger? We understand that shopping cart plugins are not your core business. That is why we are here to maintain, update, and translate all the shopping cart plug-ins. Ginger also proudly offers third-line technical support to all your merchants.

3. Offer an Omnichannel solution

Merchants who use your banking services want to offer their customers the ability to buy whenever, wherever, and however they want. Even if that means browsing in an app, placing something in a webshop cart, and then paying and collecting it at a nearby physical shop.

This is the omnichannel experience that merchants need to offer their customers nowadays. This requires the ability to share data and make payments across multiple channels (e.g., point-of-sale, mobile app, eCommerce site). No matter if the experience starts online and finishes offline (or vice versa), one thing is clear: There needs to be seamless communication between channels about customers and products.

Consumers expect this, and therefore merchants need their banks to offer an omnichannel solution. Partnering with Ginger is an easy way to satisfy this demand. You connect with us, and Ginger takes over from there by integrated point-of-sale providers and coordinating all bank-end activity. With Ginger, banks are able to offer these services on one contract and merchants get one centralized portal to get insights from their transactions on multiple channels.

4. Provide Unified Reporting

What good is the information if you have three different providers but no clue what’s happening across those channels? The logic is simple: By connecting the dots between your sales channels, it becomes easy to cater to any customer’s needs and make the necessary business improvements.

If your merchants are going omnichannel, then you need to also offer unified reporting in order to make sense of the data from all these online and offline streams. That way, you (and your merchants) can spend less time chasing up information and, instead, spend it interpreting your reports’ data and insights.

Furthermore, as a bank it is essential to gather insights across providers and combine all data in order to facilitate internal reporting processes. By linking back-end systems to capture actionable insights, deliver flexible shopping experiences, and generate lasting loyalty, Ginger will enable, compile, and customize this information for you and your merchants.

5. Stay flexible

If, over the last year, life and eCommerce has taught us anything, it is the need to stay nimble and innovative. The future is not always predictable. Payment methods, consumer habits and preferences, and other payment innovations are all evolving simultaneously. Flexibility allows you to react to unexpected or new circumstances.

It is not best to put all your eggs in one basket by selecting a larger payment provider whose priorities lay elsewhere, and who often face huge backlogs. While Ginger cannot tell you which payment method will be at the forefront over the coming years, we can guarantee that we will equip you with the agility and innovation to adapt to whatever’s on the horizon. We’ll be by your side to delete and add payment methods, solutions, and providers with ease as the ecosystem, and your customers, evolve.

Improve your Merchant Services with Ginger

In summary, if you want to improve merchant services, you need to start by:

- Offering the right, localized APMs

- Expanding your eCommerce shopping cart plugins

- Going omnichannel (eCommerce, PoS, Mobile)

- Switching to unified reporting

- Staying flexible with a partner like Ginger

Ginger is your partner in simplifying, expanding, and improving your merchant solutions. Keep your business clients and their customers happy with Ginger.

Together, we give your merchants the payment experience they deserve.